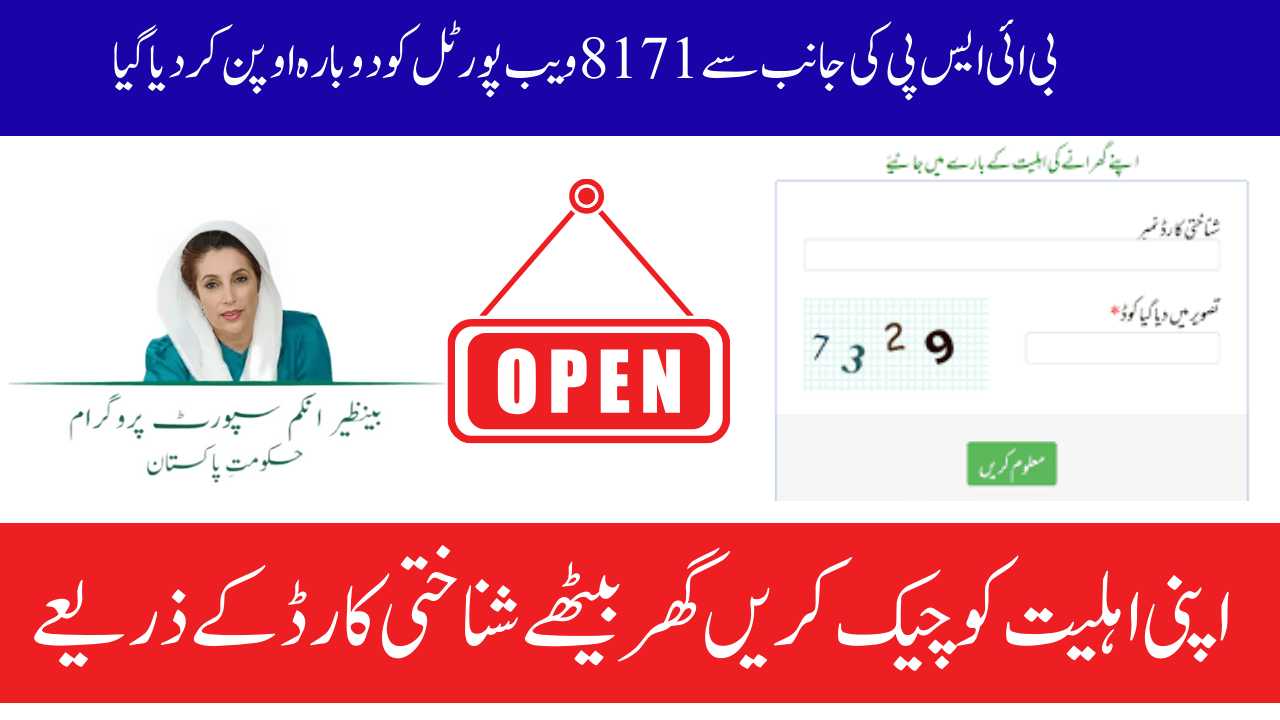

8171 Web Portal Reopens The 8171 web portal, an essential digital platform launched by the Federal Board of Revenue FBA in Pakistan, has once again reopened its virtual doors to the public, promising smoother, more transparent, and efficient tax services. This reopening marks a significant step forward in the FBR’s ongoing efforts to digitize and streamline tax processes, improve taxpayer experience, and increase revenue collection. In this article, we will explore the importance of the 8171 web portal, the reasons behind its temporary closure, the benefits it offers, and what taxpayers can expect from this reopening.

What is the 8171 Web Portal?

The 8171 web portal is an online platform designed by Pakistan’s Federal Board of Revenue to facilitate taxpayers in managing their tax-related activities. It serves as an interactive channel that enables users to register, update their profiles, file complaints, seek tax refunds, and communicate directly with tax authorities. The portal aims to simplify tax administration and improve communication between the tax department and the public.

Named after the short code 8171 the portal was initially launched as a mobile SMS service that later evolved into a comprehensive web-based system. The platform was developed to digitize tax services and bring the FBR closer to taxpayers by offering services online, reducing the need for physical visits to tax offices.

Reasons for Temporary Closure

The 8171 web portal had to be temporarily closed for routine maintenance and upgrades. This brief hiatus was necessary to address technical glitches, enhance system security, and implement new features aimed at improving user experience. Additionally, the FBR undertook backend improvements to handle increasing user traffic and data load more efficiently.

Such periodic shutdowns are standard for digital platforms, especially those handling sensitive information and large volumes of transactions. Ensuring the security of taxpayers’ data and maintaining the portal’s stability were the primary motives behind the temporary closure.

New Features and Improvements

With the reopening of the 8171 web portal, taxpayers can expect a host of new and improved features:

- The portal now boasts a more intuitive and easier-to-navigate design. This improvement will help users, including those who are less tech-savvy, to access services without difficulties.

2: The upgraded backend infrastructure ensures quicker response times for queries and requests, reducing delays and improving overall efficiency.

3: Given the sensitivity of tax-related data, the portal now features enhanced encryption and security protocols to protect users’ information from cyber threats.

4:The platform now offers a more integrated approach, allowing users to perform multiple tasks like tax registration, complaint filing, refund tracking, and status updates all in one place.

5:Recognizing the growing use of smartphones, the portal is now fully responsive and optimized for mobile devices, enabling taxpayers to use services on the go.

6: Taxpayers will receive real-time notifications and updates about their requests and submissions, keeping them informed at every step.

How to Use the Reopened 8171 Web Portal

Using the portal is straightforward. Here is a step-by-step guide:

- Go to the official 8171 web portal via the FBR website or directly through the URL provided by the tax authorities.

- New users should register by providing their CNIC (Computerized National Identity Card) and other required details. Existing users can simply log in using their credentials.

- Choose the service you wish to access, such as filing a complaint, applying for a tax refund, or updating your tax profile.

Fill out the relevant forms accurately, attach any required documents, and submit your request. - Track Pro Use the portal’s tracking feature to monitor the status of your requests and receive notifications.

Benefits for Taxpayers

The reopening of the 8171 web portal offers several benefits to taxpayers:

- Convenience: Taxpayers can now perform many tax-related activities from the comfort of their homes or offices without visiting tax offices in person.

- Transparency: The portal provides a transparent platform where taxpayers can see the progress of their applications and complaints, reducing the risk of corruption or delays.

- Time-Saving: Faster processing and easy access to information save valuable time for taxpayers.

- Better Communication: The platform facilitates direct communication with tax authorities, helping resolve issues more efficiently.

- Increased Compliance: Easy access to services encourages more people to register and comply with tax regulations, thereby improving overall tax collection.

Impact on Tax Revenue and Governance

The 8171 web portal’s reopening is expected to positively impact Pakistan’s tax system and governance. By making tax services more accessible and efficient, the FBR hopes to broaden the tax base and increase compliance rates. Digital tools like the 8171 portal reduce administrative burdens and help in detecting tax evasion.

Moreover, such digital initiatives align with Pakistan’s broader vision of e-governance, where government services are made more citizen-friendly through technology. This transparency and ease of access contribute to building trust between taxpayers and the government, essential for a robust tax culture.

FAQs – 8171 Web Portal

Q1: What is the 8171 web portal?

A: The 8171 web portal is an online platform launched by Pakistan’s Federal Board of Revenue (FBR) to help taxpayers access various tax-related services like refund requests, complaint registration, and profile updates.

Q2: Why was the portal temporarily closed?

A: The portal was temporarily shut down for technical upgrades, security improvements, and to implement new features aimed at enhancing user experience and system stability.

Q3: What services are available on the 8171 portal?

A: Services include tax refund applications, complaint submission, tax registration, profile updates, and tracking the status of submitted requests.

Q4: How can I register or log in to the 8171 web portal?

A: You can register or log in through the official FBR website or the direct 8171 portal link by providing your CNIC and other required details.

Q5: Can I use the 8171 portal on my mobile phone?

A: Yes, the portal is fully optimized for mobile devices, allowing you to access services anytime, anywhere.

Challenges and Future Prospects

Despite its many advantages, the 8171 web portal also faces challenges. Some taxpayers, especially in rural areas, may face difficulties due to limited internet access or lack of digital literacy. To address this, the government and FBR are working on awareness campaigns and digital literacy programs.

Looking ahead, the FBR plans to continuously upgrade the portal, incorporating AI-based services, chatbots for instant assistance, and integrating the platform with other government services for a seamless experience.

Conclusion

The reopening of the 8171 web portal marks a significant milestone in Pakistan’s journey towards digital tax administration. With enhanced features, improved security, and a user-friendly interface, the portal is set to transform how taxpayers interact with the Federal Board of Revenue. This initiative promises to make tax services more accessible, transparent, and efficient, benefiting both the taxpayers and the government.

As the portal evolves, it will play a vital role in promoting a culture of tax compliance and governance, contributing to the country’s economic stability and growth. Taxpayers are encouraged to make full use of this platform to simplify their tax-related processes and help build a stronger, more transparent fiscal system.